Self Assessment

What is self assessment? We get the answers to the most common queries about the dreaded tax return.

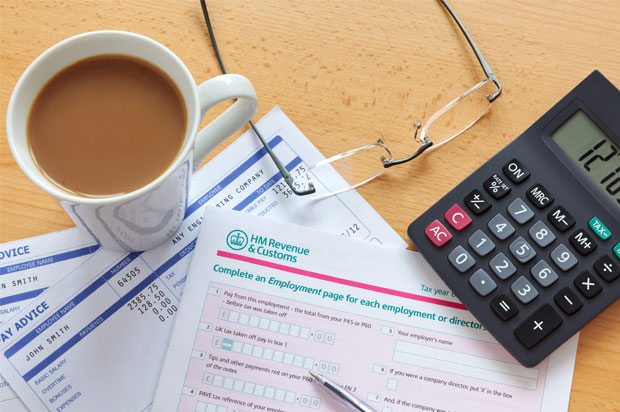

You'll need a cup of tea for this

When do I need to fill in a Self Assessment form?

If you’re self employed, run a company, or you receive income that you haven’t already paid tax on, you will need to fill out a Self Assessment form so HM Revenue & Customs (HMRC) can work out how much tax you should pay.

When your only income is what you earn from your employer, you usually won’t need to fill a form out because the right amount of tax should be taken automatically from your wages under PAYE. See our advice on understanding Pay As You Earn here.

It’s your job to tell HMRC if you need to pay tax on money you receive that isn’t already being taxed, not HMRC’s job to work it out. If you become self-employed, for example, you are required to tell HMRC and they’ll send you a tax return.

Where do I get a Self Assessment form and what’s the deadline?

According to HMRC, the self assessment timeline is as follows:

- 31 January – Self Assessment deadline (paying and filing)

- 1 February – interest accrues on any outstanding tax bills

- 28 February – last date to file any late tax returns to avoid a late filing penalty of £100 (unless you owe less than £100 in tax)

- 1 April – last date to pay any outstanding tax or make a Time to Pay arrangement, to avoid a late payment penalty

- 1 April – last date to set up a self-serve Time to Pay arrangement online

To complete the form online, go to HMRC’s website, click on Self Assessment and register. Once registered, HMRC will send you a Unique Taxpayer Reference (UTR) along with instructions on how to create a Government Gateway account. With your Government Gateway ID, you’ll be able to access the Self Assessment area to submit your tax return.

The Self Assessment form looks massive – how do I fill it in?

When you receive the tax return form you’ll also be sent lots of notes and help sheets. If you get stuck you can call a special helpline on 0300 200 3310 (open Monday to Friday: 8am to 6pm).

Anyone can fill out the form for you as long as you sign and date it and make sure that all the details on the form are correct.

Common Self Assessment mistakes

The most common mistake made when filling out a Self Assessment form is to forget to sign and date the form or to leave some details out, so always check you’ve answered all the relevant questions before you send it off.

What happens when I fill in my form? Will I have to pay more tax?

You only have to pay tax on amounts over your tax-free allowance, so if you’ve already had the correct tax deducted by your employer then you won’t have to pay it again.

If you fill in your form online you’ll see a calculation of your tax come up straight away and if you fill in a paper form, HMRC will tell you how much tax you owe.

You might also have to make a ‘payment on account’, which is basically a payment in advance that counts towards next year’s tax bill.

What do I need to prove my income?

If you’re employed you should receive a P60 at the end of the tax year – this will tell you your earnings and tax deductions for the year. If you’ve left any jobs during the year then you will have received a P45, so make sure you keep hold of them.

If you’re self employed you should keep a full and accurate business record and you should also show any money you have coming in and out of any business accounts.

You do not usually have to submit proof of your income with the tax return itself, but HMRC can sometimes ask you questions about the return later, so be prepared to back up your figures if asked.

I’m a student with a small money-making hobby. Do I count as self employed?

If you have a hobby that brings in some money, you may be considered to be self employed and will need to put details on your tax return.

This includes items you are selling on online auction sites beyond getting rid of some stuff you don’t want.

The best thing to do is to contact your local tax office to get further advice.

How long do I need to keep my tax records for?

You will need to retain your records for five years from the latest date by which your tax return has to be sent in.

Where can I get help?

Aside from the helpline (as detailed above), you can also use HMRC’s webchat service, or tweet them if you have any general questions: @HMRCcustomers.

HMRC can help answer questions about completing your tax form, but if you don’t have the time or confidence to handle your own tax affairs you’ll need to get professional help.

You can get much more information on the Low Incomes Tax Reform Group (LITRG) website and from the charity TaxAid (0345 120 3779).

If you can afford to pay someone you will need a tax advisor or accountant. Start by asking your family or friends to recommend a good one. Make sure they are registered with one of the six professional bodies:

Charges vary enormously so make sure the costs are not going to outweigh the savings. Always get a firm quote before they start to act for you. For a simple tax return service you can expect to pay a fee of at least £100.

Next Steps

- The Money Helper offers free, unbiased and independent advice about all financial matters. 0800 138 7777

- Chat about this subject on our Discussion Boards.

By Holly Turner

Updated on 25-Jun-2021

No featured article